**Greek Imports of Linseed Rise Amid Strong Demand**

**Supply Chain Disruptions Boost Prices for Greek Manufacturers**

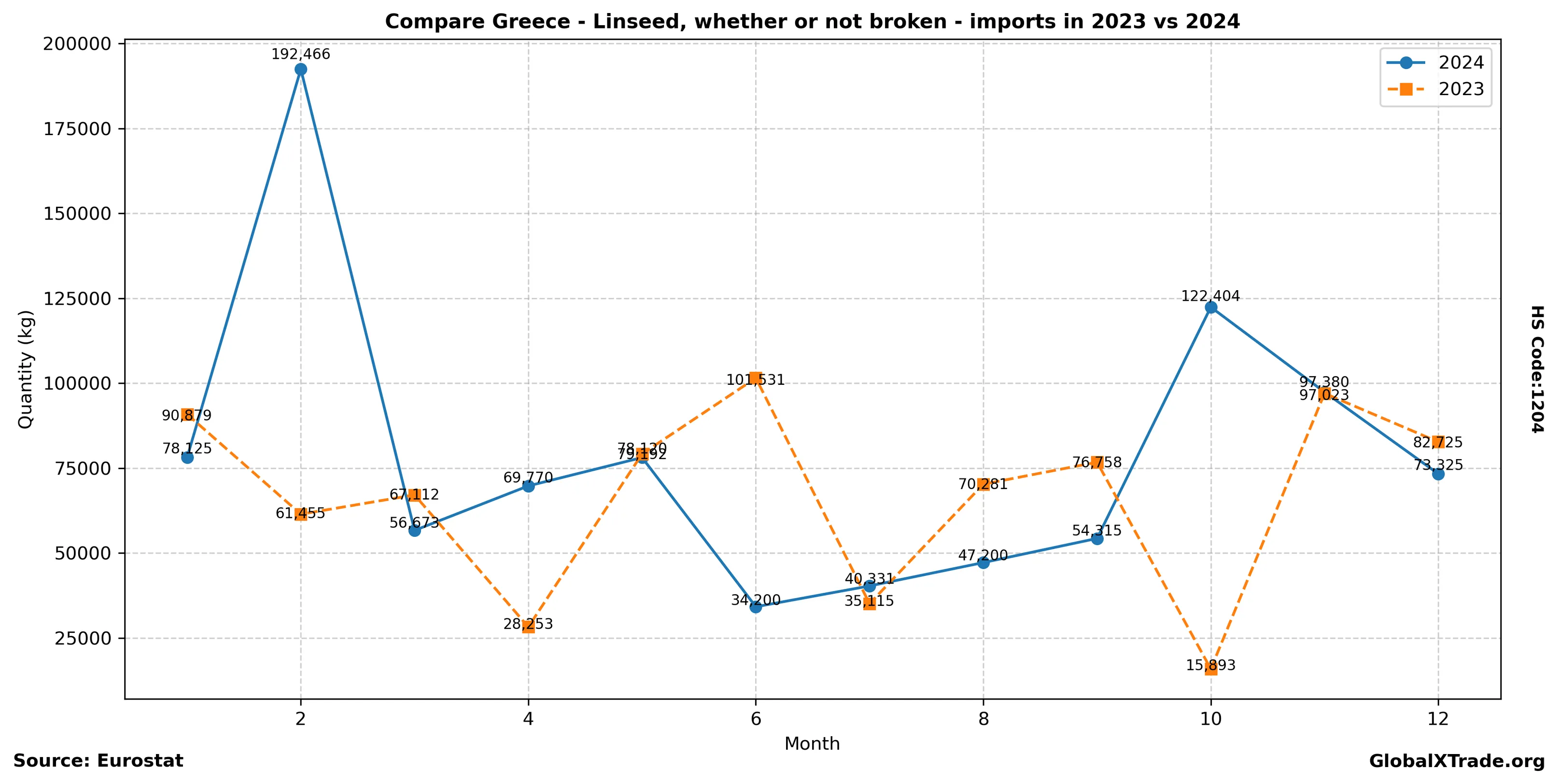

• Total imports of linseed into Greece rose by 12% in May, compared to the same month last year.

• The majority of imported linseed came from countries outside the EU, with Romania and Ukraine being the largest suppliers.

• Prices for linseed have increased by 8.5% over the past three months due to supply chain disruptions and strong demand from manufacturers.

Greece’s imports of linseed are expected to continue growing in the coming months as domestic manufacturing activity expands, driven by strong demand from the food processing sector. The country’s reliance on non-EU suppliers has contributed to higher prices for linseed, which could impact production costs for local manufacturers.

Yearly Import Summary

| year | total_quantity_kg | total_value_eur |

|---|---|---|

| 2020 | 797,492 | 600,068 |

| 2021 | 757,552 | 735,740 |

| 2022 | 617,173 | 761,299 |

| 2023 | 806,217 | 714,675 |

| 2024 | 944,309 | 783,537 |

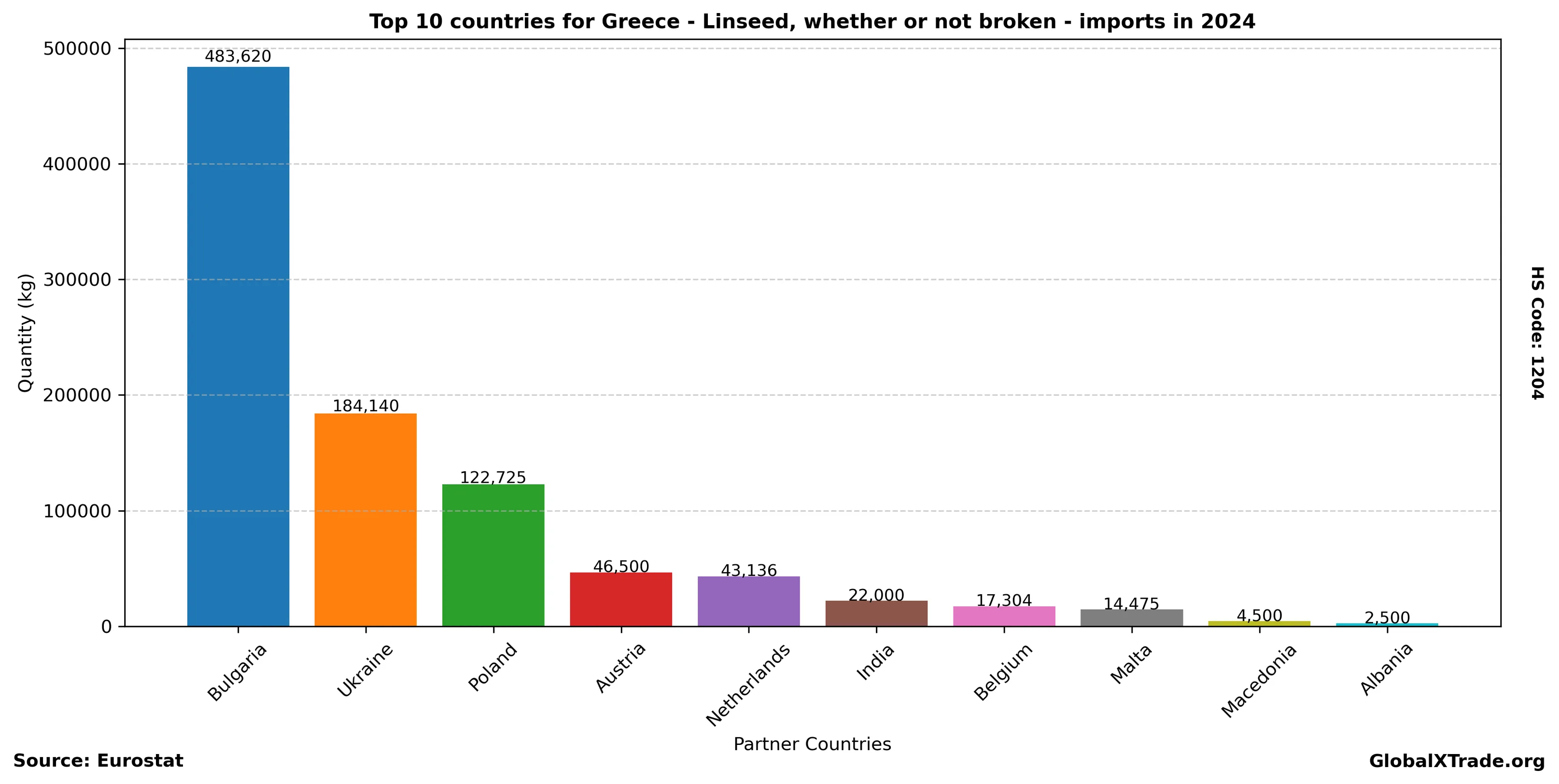

Top Partner Countries 2024

| partner | total_quantity_kg | total_value_eur |

|---|---|---|

| Bulgaria | 483,620 | 327,420 |

| Ukraine | 184,140 | 115,959 |

| Poland | 122,725 | 105,546 |

| Austria | 46,500 | 41,698 |

| Netherlands | 43,136 | 82,371 |

| India | 22,000 | 32,070 |

| Belgium | 17,304 | 26,572 |

| Malta | 14,475 | 33,239 |

| Macedonia | 4,500 | 4,396 |

| Albania | 2,500 | 2,530 |

Top Partner Countries 2023

| partner | total_quantity_kg | total_value_eur |

|---|---|---|

| Poland | 315,152 | 221,526 |

| Ukraine | 152,190 | 92,383 |

| Bulgaria | 110,795 | 53,790 |

| India | 66,180 | 65,539 |

| Netherlands | 55,954 | 85,886 |

| Belgium | 40,000 | 42,293 |

| Malta | 22,650 | 60,476 |

| Egypt | 21,500 | 30,046 |

| Germany | 16,110 | 55,825 |

| Canada | 5,000 | 3,616 |