**Greek Imports of Mica Rise Amid Global Supply Concerns**

**Mica Demand Spurs Greek Imports Amid Seasonal Peak**

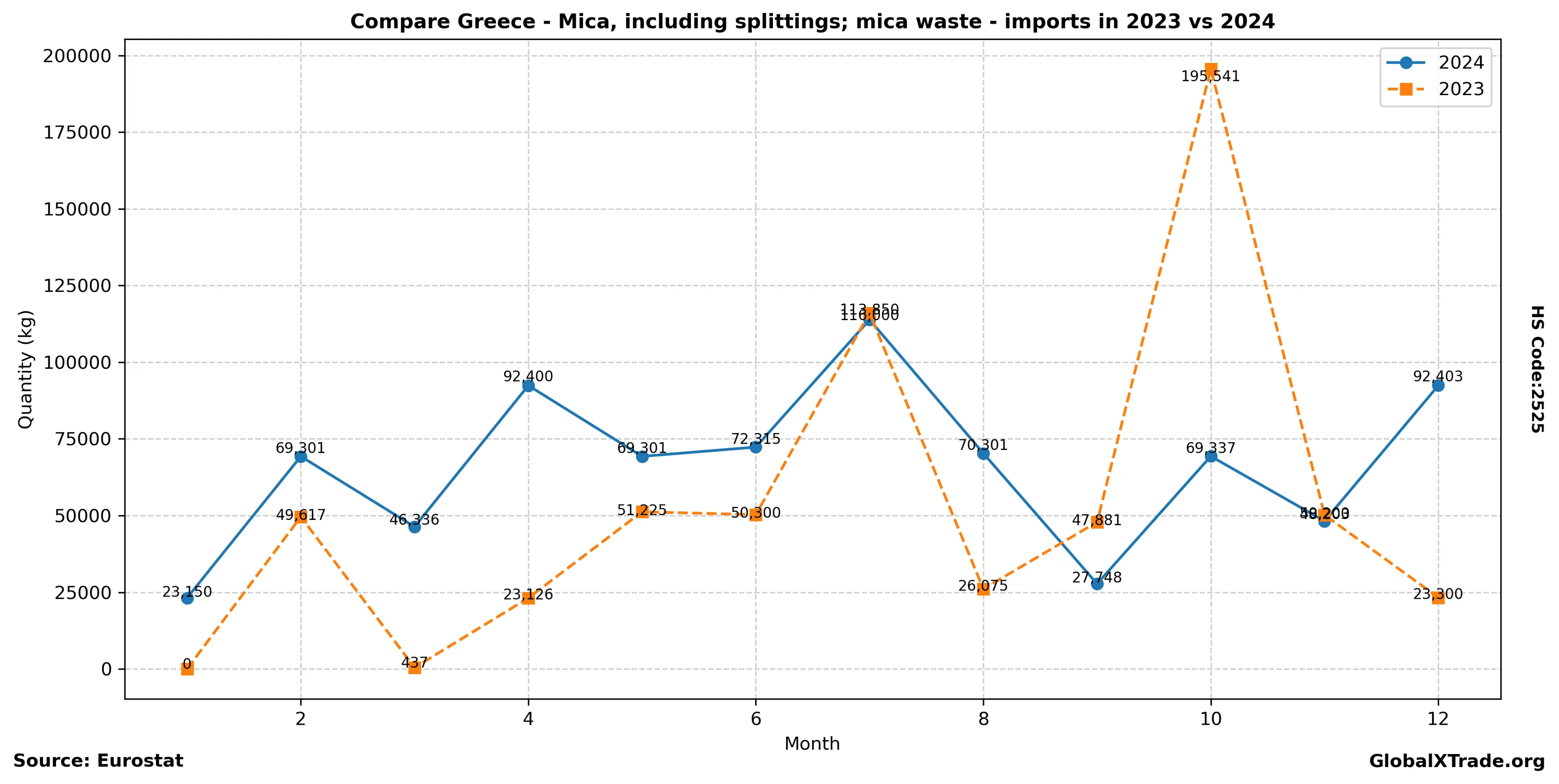

• Greek imports of mica rose by 12% in June from the same period last year, according to customs data.

• The increase was driven by a surge in demand for electrical insulation materials in the automotive sector.

• Prices for high-quality mica remained stable at around $2,500 per tonne due to a balanced supply and demand situation.

Greek imports of mica, used primarily in electrical insulation applications, have experienced a seasonal uptick in June as construction and manufacturing activities accelerate. The increase in imports comes amid concerns over global mica supply chains, which have been impacted by production disruptions in key markets. As the European summer season peaks, Greek importers are seeking to secure adequate supplies of high-quality mica to meet growing demand from domestic industries.

Yearly Import Summary

| year | total_quantity_kg | total_value_eur |

|---|---|---|

| 2020 | 294,170 | 252,889 |

| 2021 | 603,965 | 493,051 |

| 2022 | 715,108 | 790,933 |

| 2023 | 633,702 | 515,713 |

| 2024 | 794,645 | 614,757 |

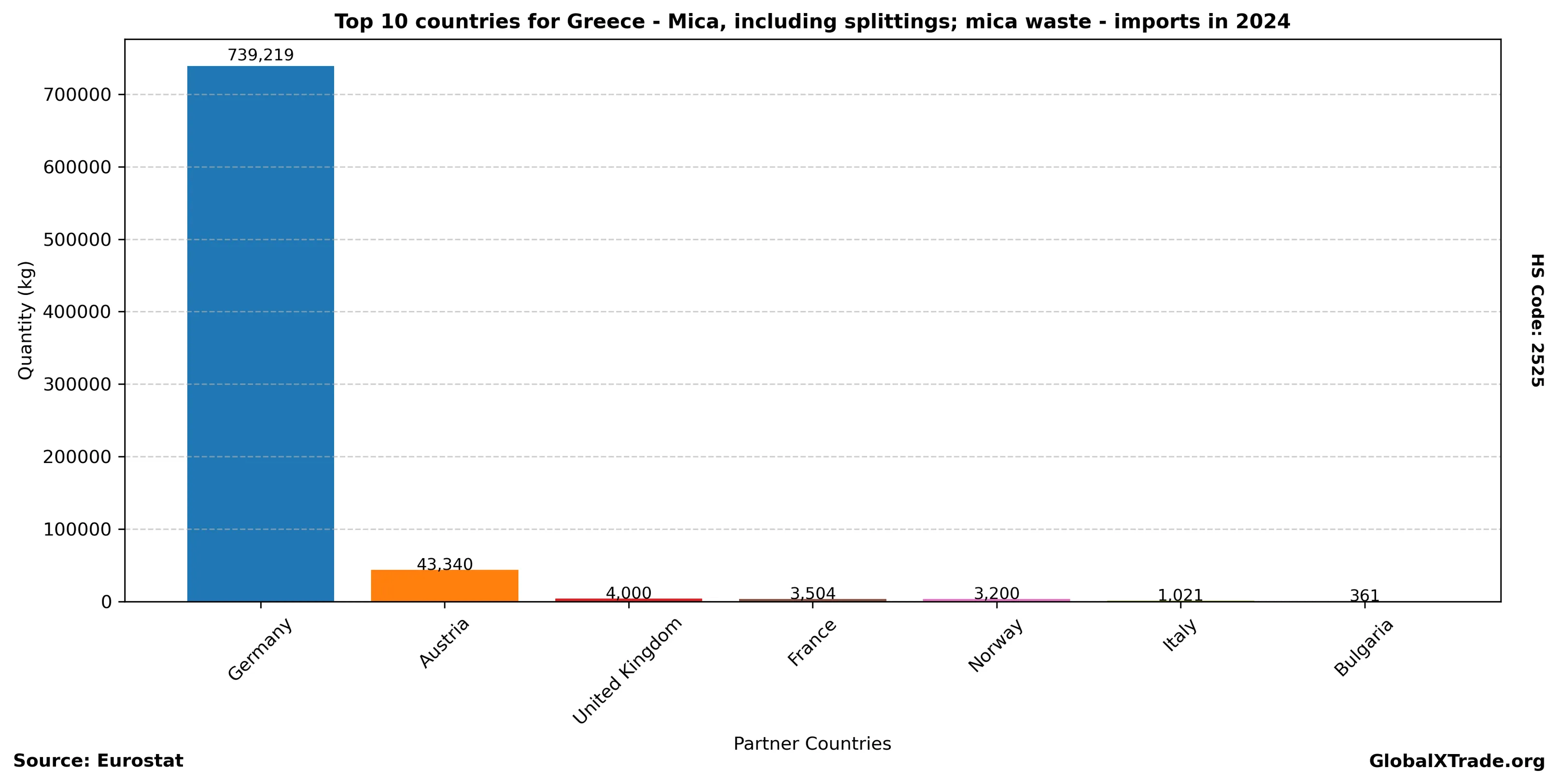

Top Partner Countries 2024

| partner | total_quantity_kg | total_value_eur |

|---|---|---|

| Germany | 739,219 | 536,006 |

| Austria | 43,340 | 28,292 |

| United Kingdom | 4,000 | 6,604 |

| France | 3,504 | 13,803 |

| Norway | 3,200 | 5,598 |

| Italy | 1,021 | 2,478 |

| Bulgaria | 361 | 21,976 |

Top Partner Countries 2023

| partner | total_quantity_kg | total_value_eur |

|---|---|---|

| Germany | 511,750 | 417,892 |

| Netherlands | 80,000 | 24,160 |

| Austria | 26,385 | 18,071 |

| United Kingdom | 8,000 | 12,680 |

| India | 2,975 | 2,553 |

| France | 2,334 | 9,013 |

| Norway | 1,600 | 2,396 |

| Bulgaria | 552 | 28,177 |

| Italy | 103 | 649 |

| China | 3 | 122 |