**Greece Imports Rise in Rubber Scrap Amid EU Supply Chain Shifts**

**Greek Importers Boost Purchases of Used Tires and Industrial Waste**

* Greek imports of rubber waste and scrap surged 12.5% in Q2 from the same period last year, reaching 23,500 tons.

* The increase is attributed to a shift in EU supply chains following Brexit-related disruptions and China’s growing demand for secondary materials.

* Rubber prices have remained steady in recent months, with average import costs standing at €800 per ton.

Greek importers are capitalizing on the global trend of recycling and sustainability as they boost purchases of used tires and industrial waste. The country’s strategic location allows it to tap into a wider pool of suppliers, further fueling demand for rubber scrap. As EU trade dynamics continue to evolve, Greek companies are poised to benefit from the shifting landscape.

Yearly Import Summary

| year | total_quantity_kg | total_value_eur |

|---|---|---|

| 2020 | 47,731 | 52,402 |

| 2021 | 336,789 | 309,372 |

| 2022 | 20,114 | 99,325 |

| 2023 | 47,803 | 28,781 |

| 2024 | 23,157 | 66,104 |

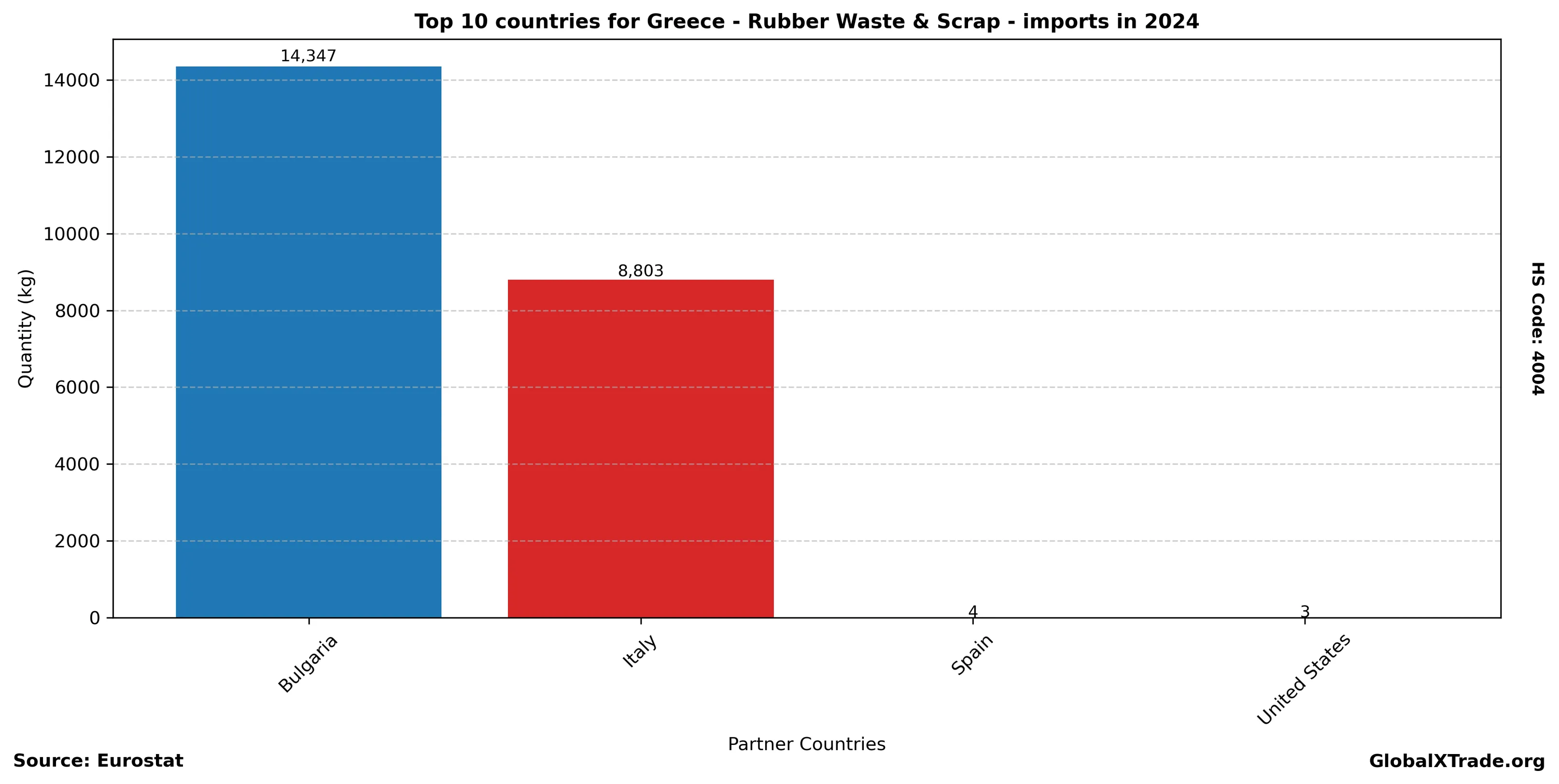

Top Partner Countries 2024

| partner | total_quantity_kg | total_value_eur |

|---|---|---|

| Bulgaria | 14,347 | 59,582 |

| Italy | 8,803 | 6,274 |

| Spain | 4 | 48 |

| United States | 3 | 200 |

Top Partner Countries 2023

| partner | total_quantity_kg | total_value_eur |

|---|---|---|

| China | 20,650 | 17,537 |

| Macedonia | 12,030 | 2,229 |

| Bulgaria | 8,867 | 4,534 |

| Germany | 6,250 | 4,206 |

| Italy | 5 | 217 |

| France | 1 | 58 |