**Greece Sees Surge in Fresh Grape Imports Amid European Harvest Shortage**

**EU Market Drought Drives Demand for Non-EU Supplies**

• The European Union’s grape harvest is expected to decline by 10% this season due to unfavorable weather conditions.

• Greece has seen a notable increase in fresh grape imports from non-EU countries, including Chile and South Africa.

• Prices for EU-grown grapes have risen by 15% year-over-year, making imports more competitive.

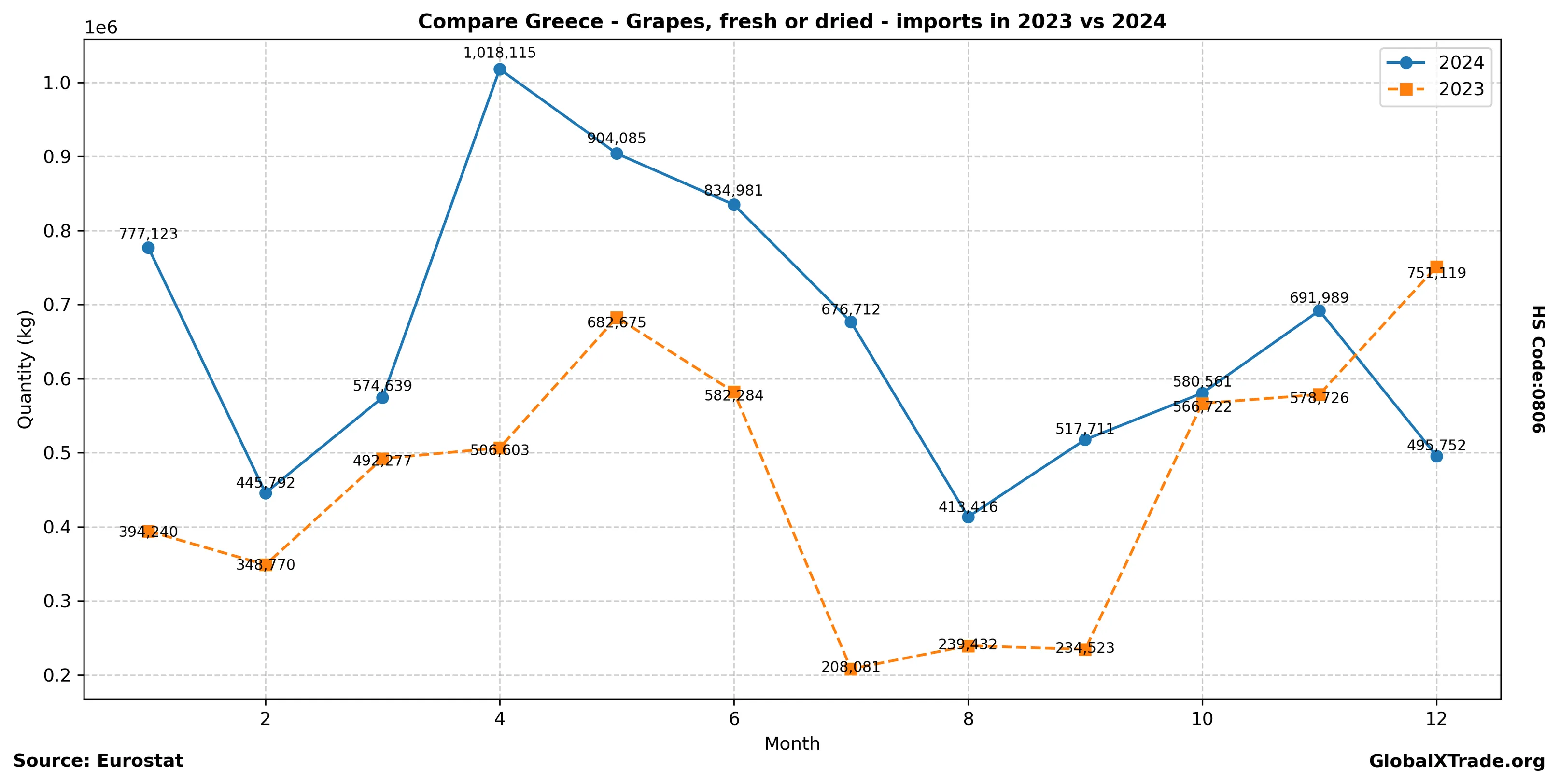

As the European Union’s grape harvest faces a decline of 10% this season due to unfavorable weather conditions, Greece is witnessing a significant surge in fresh grape imports from non-EU countries. The rise in prices for EU-grown grapes has made imports more attractive, with Chile and South Africa emerging as key suppliers. This trend is expected to continue throughout the summer months as domestic supplies dwindle.

Yearly Import Summary

| year | total_quantity_kg | total_value_eur |

|---|---|---|

| 2020 | 7,009,831 | 7,948,752 |

| 2021 | 3,799,505 | 5,051,925 |

| 2022 | 3,858,467 | 6,406,576 |

| 2023 | 5,585,452 | 9,330,554 |

| 2024 | 7,930,876 | 14,196,747 |

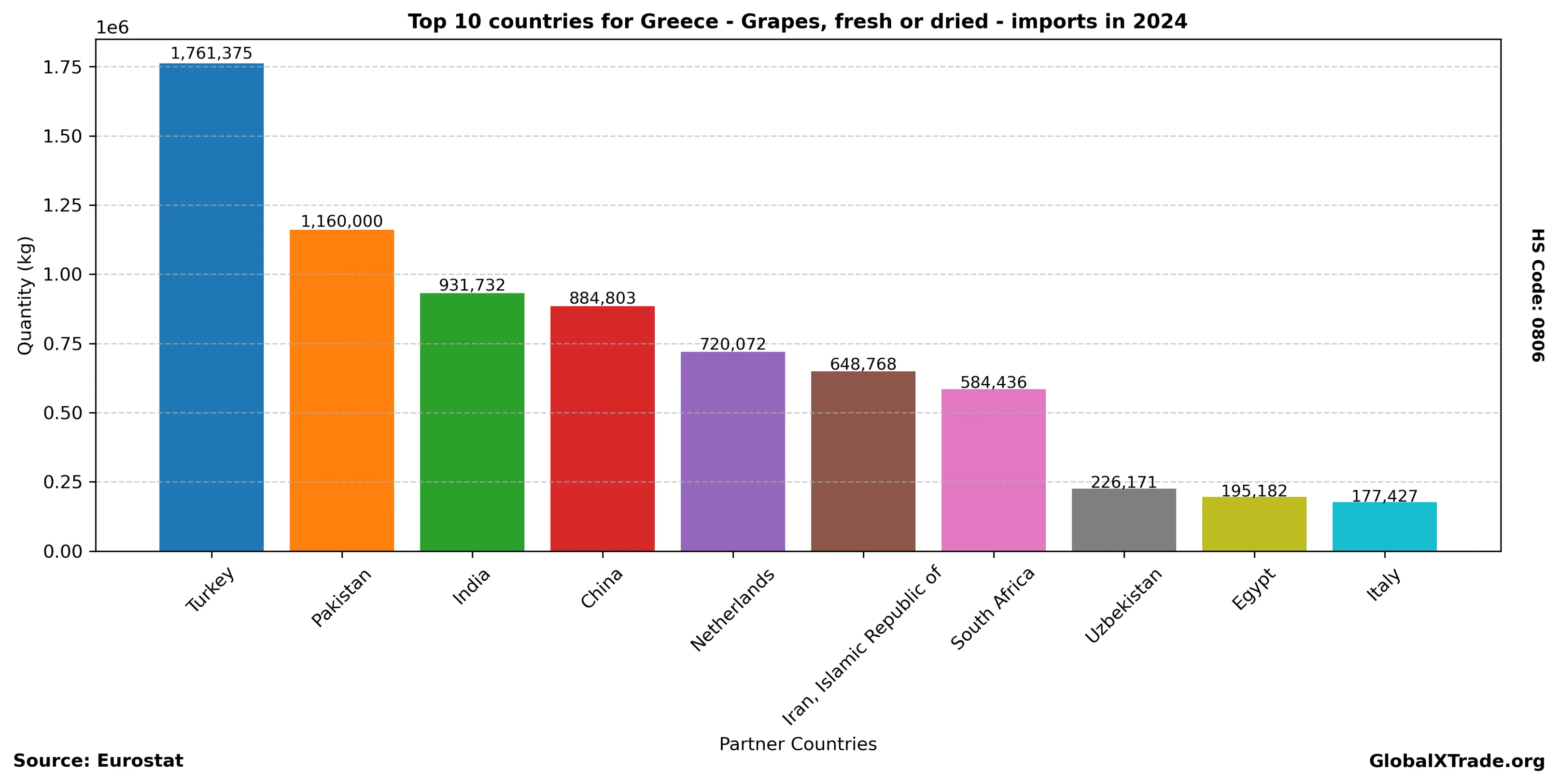

Top Partner Countries 2024

| partner | total_quantity_kg | total_value_eur |

|---|---|---|

| Turkey | 1,761,375 | 5,421,636 |

| Pakistan | 1,160,000 | 600,331 |

| India | 931,732 | 733,007 |

| China | 884,803 | 711,622 |

| Netherlands | 720,072 | 1,972,832 |

| Iran, Islamic Republic of | 648,768 | 1,341,979 |

| South Africa | 584,436 | 606,723 |

| Uzbekistan | 226,171 | 336,774 |

| Egypt | 195,182 | 353,092 |

| Italy | 177,427 | 400,159 |

Top Partner Countries 2023

| partner | total_quantity_kg | total_value_eur |

|---|---|---|

| Turkey | 2,151,241 | 4,032,112 |

| Netherlands | 729,213 | 1,825,910 |

| China | 609,000 | 227,268 |

| Pakistan | 400,000 | 146,597 |

| Germany | 245,191 | 543,047 |

| Italy | 230,431 | 465,455 |

| South Africa | 179,456 | 190,788 |

| Iran, Islamic Republic of | 175,295 | 331,161 |

| Egypt | 153,534 | 272,503 |

| United Kingdom | 142,169 | 193,751 |