**Greece’s Vegetable Imports Surge Amid EU Harvest Season**

**Greek companies stock up on vegetable materials ahead of peak demand**

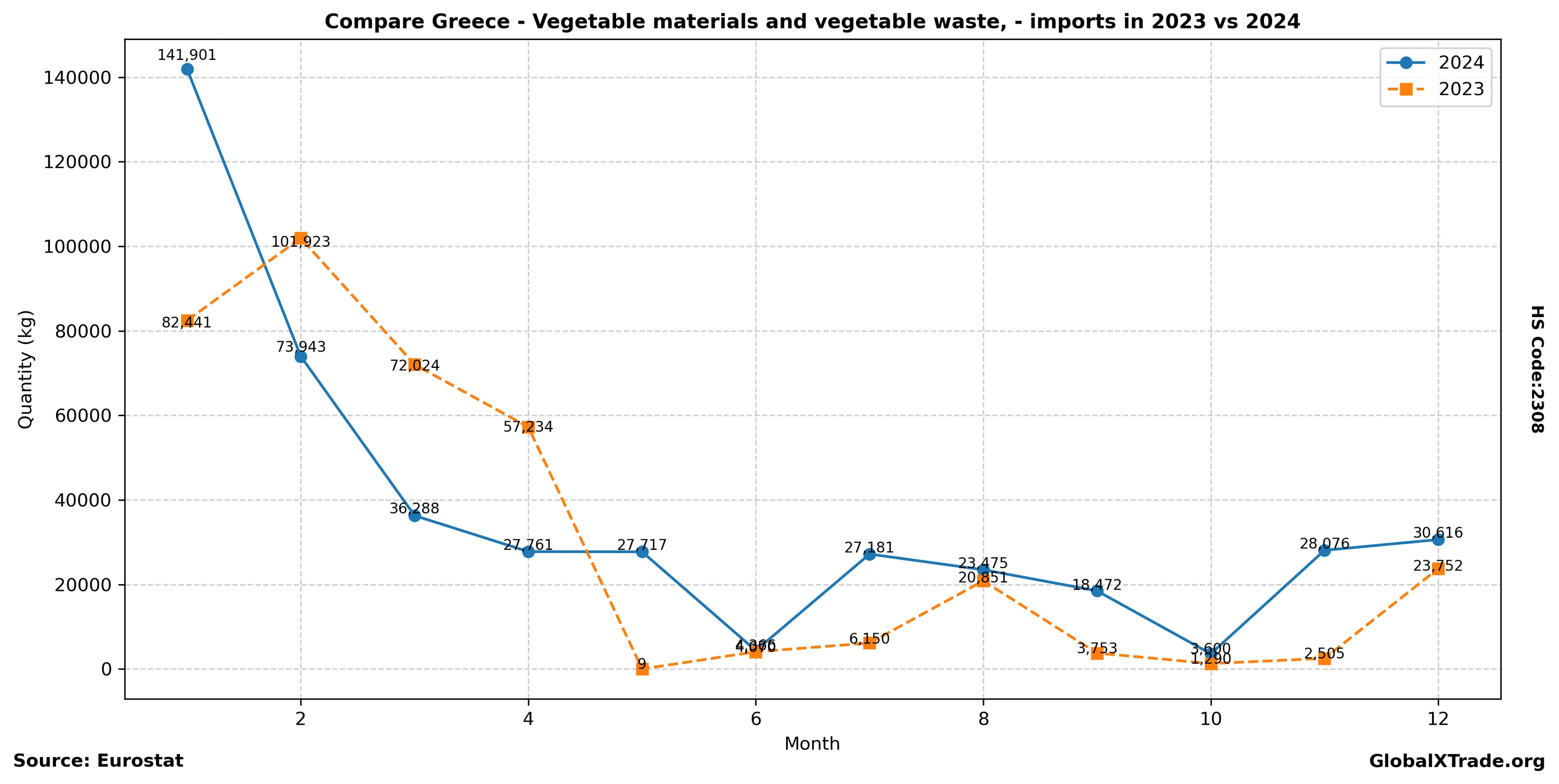

• Greece imported 12% more vegetable materials in the first quarter compared to the same period last year.

• The increase is largely driven by demand from the country’s food processing industry, which relies heavily on imports during the EU harvest season.

• Prices for vegetable materials have risen by 5% over the past three months due to supply chain disruptions and favorable global market conditions.

Greece’s vegetable import surge comes as the European Union enters its peak harvesting period. The country’s food processing industry is benefiting from the increased availability of high-quality vegetable materials, driving up demand for imports. As a result, prices have risen, with Greek companies seeking to capitalize on the opportunities presented by the strong global market.

Yearly Import Summary

| year | total_quantity_kg | total_value_eur |

|---|---|---|

| 2020 | 2,976,067 | 2,462,930 |

| 2021 | 3,232,611 | 2,179,485 |

| 2022 | 2,041,586 | 2,059,823 |

| 2023 | 376,002 | 553,260 |

| 2024 | 443,396 | 621,404 |

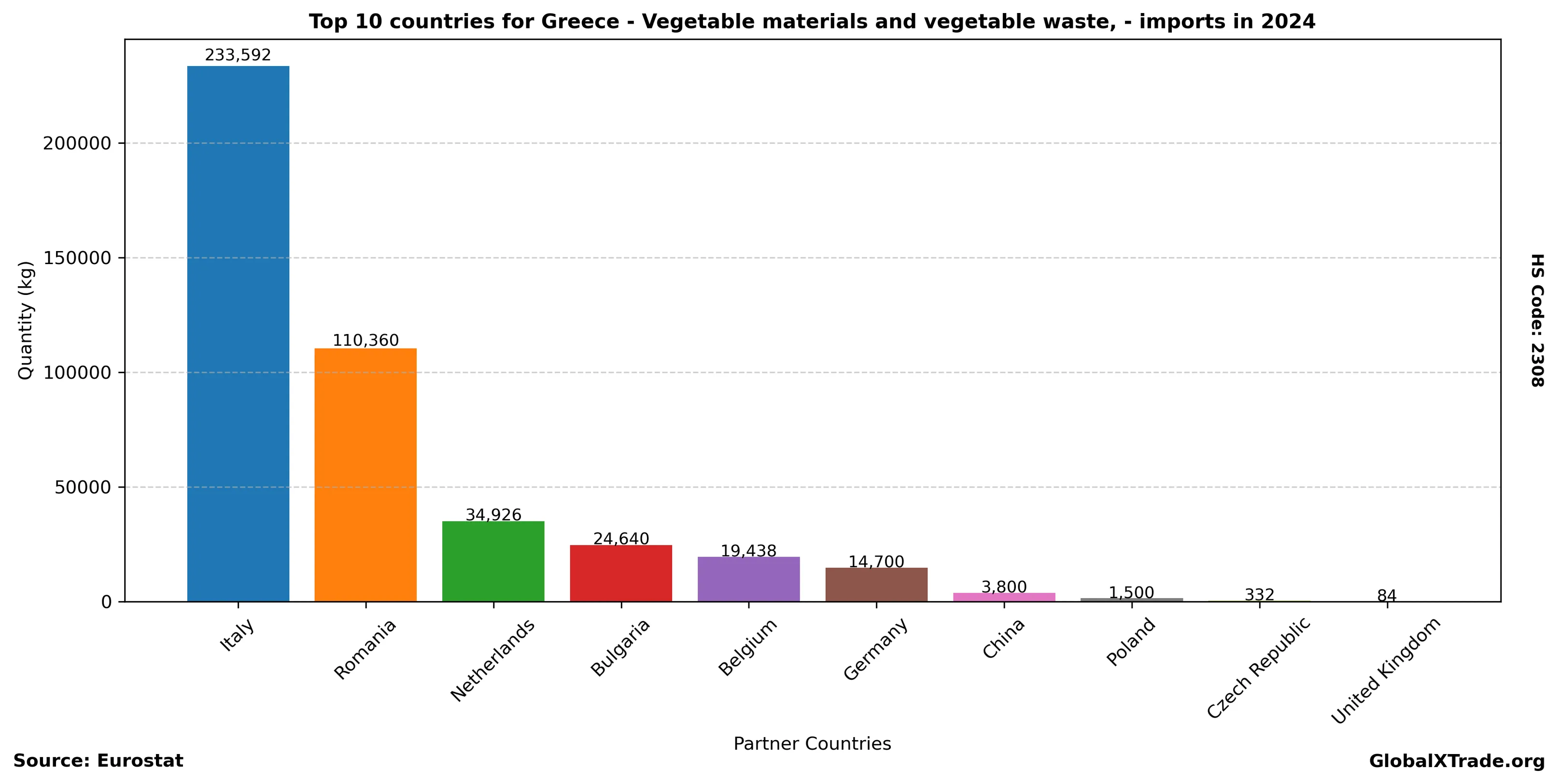

Top Partner Countries 2024

| partner | total_quantity_kg | total_value_eur |

|---|---|---|

| Italy | 233,592 | 263,952 |

| Romania | 110,360 | 36,970 |

| Netherlands | 34,926 | 36,217 |

| Bulgaria | 24,640 | 6,406 |

| Belgium | 19,438 | 130,217 |

| Germany | 14,700 | 16,371 |

| China | 3,800 | 118,806 |

| Poland | 1,500 | 9,695 |

| Czech Republic | 332 | 2,454 |

| United Kingdom | 84 | 118 |

Top Partner Countries 2023

| partner | total_quantity_kg | total_value_eur |

|---|---|---|

| Italy | 258,401 | 262,744 |

| Bulgaria | 48,720 | 11,683 |

| Netherlands | 36,290 | 40,255 |

| Germany | 18,770 | 23,520 |

| Belgium | 9,820 | 98,451 |

| China | 3,500 | 112,961 |

| Czech Republic | 453 | 3,361 |

| Poland | 25 | 42 |

| United States | 22 | 209 |

| United Kingdom | 1 | 34 |