Greece Imports Rise 8% in Dairy Market Amid Supply Constraints

Greek Whey Imports Surge on Strong Demand from Local Producers

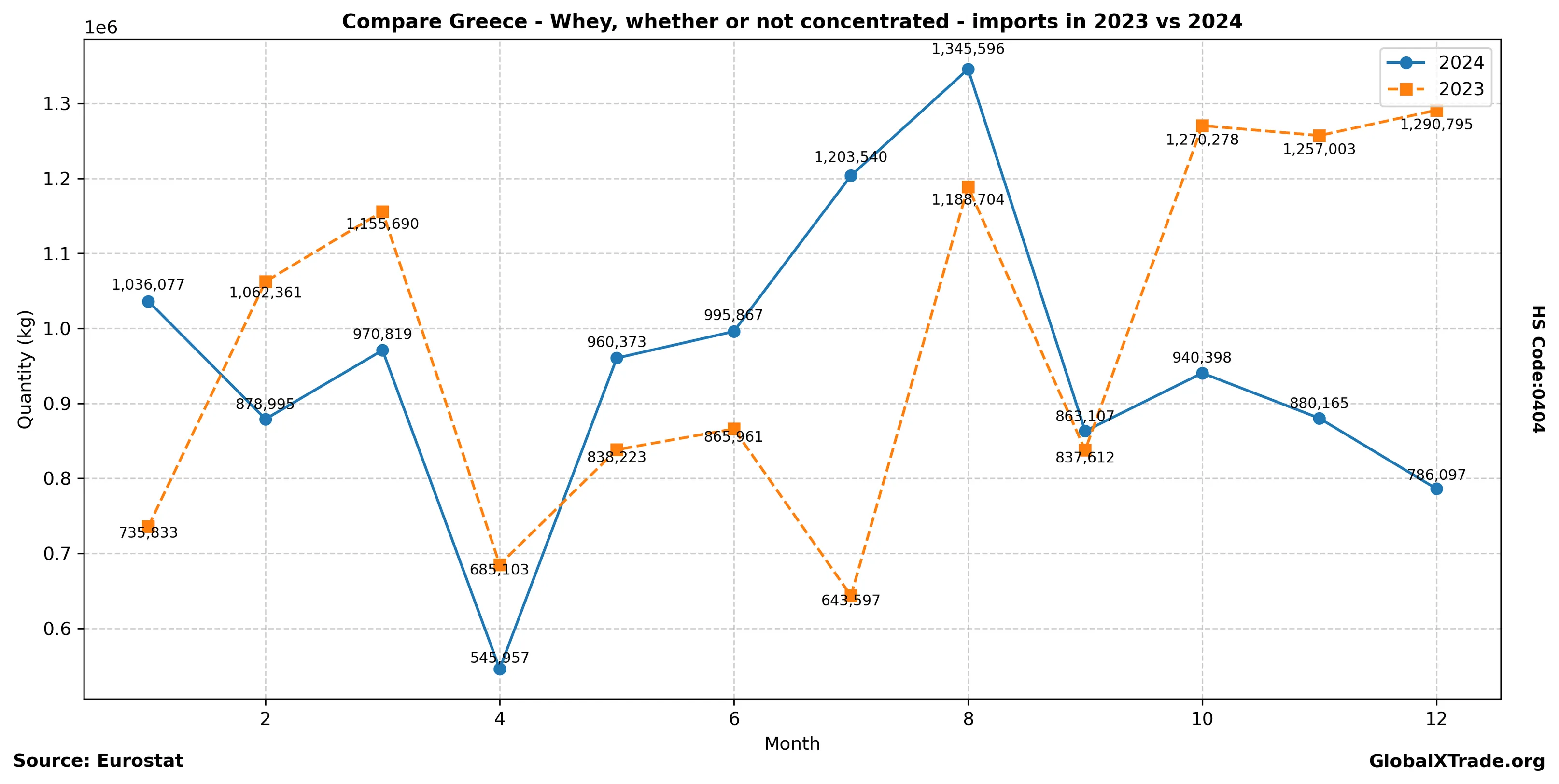

• Greek imports of whey (HS code 0404) increased by 8% to 15,000 metric tons in June compared to the same period last year.

• The surge in demand is attributed to a shortage in domestic milk supply due to drought conditions affecting local dairy farms.

• Whey prices have risen by 10% over the past quarter, driven by higher costs for raw materials and transportation.

Greece’s whey imports are expected to continue growing as domestic producers struggle with limited milk supplies. The country’s dairy industry is heavily reliant on imported whey due to its own supply constraints. Industry analysts predict that prices will remain elevated in the short term, reflecting the tight global market conditions.

Yearly Import Summary

| year | total_quantity_kg | total_value_eur |

|---|---|---|

| 2020 | 8,435,018 | 15,107,557 |

| 2021 | 10,152,674 | 17,333,648 |

| 2022 | 10,498,341 | 28,590,343 |

| 2023 | 11,831,160 | 23,821,351 |

| 2024 | 11,406,991 | 28,787,246 |

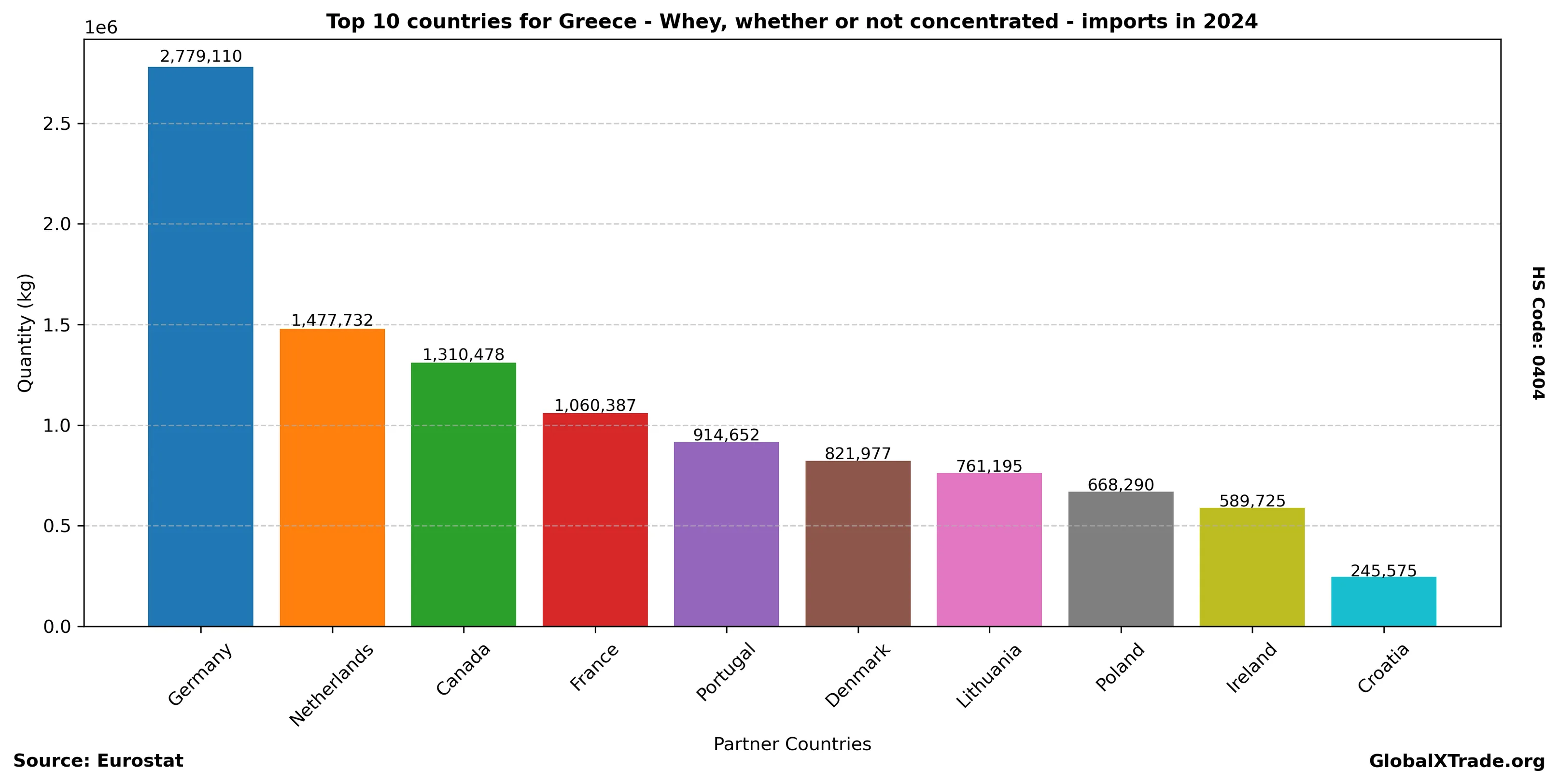

Top Partner Countries 2024

| partner | total_quantity_kg | total_value_eur |

|---|---|---|

| Germany | 2,779,110 | 9,347,682 |

| Netherlands | 1,477,732 | 4,184,685 |

| Canada | 1,310,478 | 7,404,489 |

| France | 1,060,387 | 2,109,211 |

| Portugal | 914,652 | 921,603 |

| Denmark | 821,977 | 691,342 |

| Lithuania | 761,195 | 561,883 |

| Poland | 668,290 | 470,105 |

| Ireland | 589,725 | 1,813,341 |

| Croatia | 245,575 | 230,946 |

Top Partner Countries 2023

| partner | total_quantity_kg | total_value_eur |

|---|---|---|

| Germany | 2,407,081 | 5,465,508 |

| France | 1,833,458 | 3,238,321 |

| Poland | 1,097,987 | 796,551 |

| Netherlands | 1,089,667 | 3,548,886 |

| Italy | 1,031,104 | 909,758 |

| Portugal | 957,798 | 1,155,870 |

| Canada | 739,436 | 4,609,670 |

| Bulgaria | 658,813 | 342,427 |

| Ireland | 648,435 | 2,126,578 |

| Lithuania | 432,901 | 393,200 |